The Stock Market is the transfer of wealth from active to passive—Warren Buffet. The most bracing impression about how to trade CFD is that anybody can perform it.

Table of Contents

Definition of Making Money—Contract For Differences

CFD holds for Contract for Difference— is an agreement to swap the difference of price inclinations or bents in a financial market.

Traders do not own shares of a company or Asset; preferably has the right to buy or sell individual shares or contracts on margin, which appears in a profit or loss to the trader. CFD trading strategies are just other trading channels for you to contemplate with whose value is derived from an underlying asset, exchange-traded, market-exchange.

What is CFD (Contract For Difference)?

ContractForDifference is a leveraged ‘acquired’ financial stock. CFD’s are derivatives because their worth comes from the value of some other undefined asset (for example, shares, commodities, or from the market index). In clear words, when you are trading Contract For Difference — you are gambling on if the value of the put in question Asset is going to fall or rise in the future compared to what its price initially was when taken out.

All the Contact For Difference enterprises let you trade for— both long and short terms. In a short time, CFD means selling a CFD with the expectation that the asset will decrease in value. And playing for the Long Term means buying a CFD in the hope that the assets will increase in price. In both of the cases, when you close the contract, you hope to gain the difference between the closing value and the primary value.

Consider, for example— when you are buying a CFD for long term for a company’s X number of shares. And, if the price of the X number of shares rises and you call out your Contract For Difference, the seller of the CFD(the counterparty) will pay you the difference between the current price of the shares and the price when you call out the agreement(the contract).

Nevertheless, if the price of Company X number of shares declines, then you would have to give the difference in price to the seller of the contract. And, this could be much than the money you originally put in, because of the leverage you take to make the Contract For Difference happen. However, unlike your Netflix recharge, CFDs do not have an expiry period, so you can call out the contract when you feel it is profitable for you.

(Image credit: HF Markets)

CFD TERMINOLOGIES:

Margin and Leverage

This is a deposit used as collateral to control a more substantial position. However, CFD brokers differ with their margin requirements for a different individual asset, and the general and most notable conditions are about 5% the value and the leverage of the proportion(20:1).

Dividends

CFD brokers open an account for dividend adjustments(if they are not, they might be a fraudster); this is done for a simple debit(if you are going short) or credit (if you are going long).

NOTE: Dividend regulations only occur if the underlying asset of the shares get operated, revealed, and pays a dividend to its shareholders.

Contract Size

This is a minimum amount of the asset that you can control.

DMA

Stands for Direct Market Access—using this, you can trade directly into the order books of the underlying Global Finances and gives the ability to purchase/sell inside the spread on individual shares.

(Image Credit: Blackwell Global)

How To Start Trading CFDs

One of the beneficial points of trading with CFDs is how outspoken it is to progress. You’ll necessitate following these five steps.

1. Choose A Market

There are many options to choose from while developing CFD trading strategies, and that includes commodities, currencies, and interest rates, and individual bonds. These are the major CFD Pros as CFD consists of these many options.

You can choose a market in which you feel you have a good understanding. This CFD strategy will help you react to the market developments considering CFD trading strategies get change overtime. Nowadays, almost all of the CFD platforms have a search function that makes this process easy and quick.

2. Buy Or Sell

If you are buying, you have to deal for a more extended period. This price is termed as bid (or the or sell price).

If you are selling, you play for a short time. And this is termed as an offer(or buy price).

The price of your CFD trading strategy is based on the amount of the Underlying Asset. If you believe that the market will increase in value, you buy. And, if you have the reason to believe that the market will decline, you sell.

Read my previous article related to Forex Trading, where you will understand what affects the market.

Trade Size

You have to select the size of the CFD you want to trade. With a CFD trading strategy, you can control the size of your investment. As the value of the underlying asset varies over time, you can decide how much you want to invest. Brokers will give you a margin requirement ( a minimum amount that is needed for your trade to begin)—depends on the individual underlying Asset.

For example, Asset such as cryptocurrency has high margin requirements. Consider, you have an exposure to $5000 worth of a particular cryptocurrency, then you need a margin of $2000—as these are subjects of higher risk, but again higher the risk more the profit.

But considering a well-treaded share—Facebook, where you only need to invest 5% of the margin, so for $5000 position, you only require $250 of the account funds.

Add Stops & Limits

This could be included in the below list of CFD Pros, as this helps you secure profits and avoid any possible losses. Most CFD trading strategy for beginners will employ the use of Stop Losses and Limit Orders. Once you know the subjected risk, you can place as Stop Loss to close a trade—once the market hits the level, you presumed. This will help you minimize loss and keep your account in the black.

And a Limit Order will instruct your platform to closedown a trade that is well and better than the current market levels.

If you consider opting for CFD trading Bot, they will use the instructions like these to begin and close trade of your trading plan. And, these CFD trading Bots are perfect for closing deals near resistance level—(Read my previous article—Forex Trading to help understand this), without having to monitor all the positions all the time.

Monitor & Close

Once you are done with your first trade and Stop or Loss limits, your profits will vary according to the market price. You can view the market changes in real-time, and you can accordingly add a new trade or close a trade.

With some best platforms listed below, this could be done quickly.

And, if your stop loss or the limit orders has not been activated, you can close it manually. Simply, point-out the Close Position option from the position window—you can see your profit or loss almost instantly in your accounts.

Now that you have understood—

What is CFD? And How to Start Trading CFD’s?

Let’s proceed with CFD Pros and CFD Cons.

CFD Pros

Leverage (with margin)

If you place a small deposit so that your margin requirement gets fulfilled, you can hold a more significant position than you would without leverage. Thus you can earn a higher return on the investment—this is the preeminent CFD Pros.

No stamp duty is another CFD Pros

As you are subjected to purchase any assets, you don’t need to access the actual exchange to transact, and therefore there is no stamp duty imposition on CFD transactions.

No time expiry

While counting down the CFD Pros, we have to give some roof to CFD’s time expiry as in CFD’s trading; there is no limit to how long or short you want to hold a position as it is not time-bound. This may not be suitable for all the trading methods, but here you can keep a position given any length of time, so long as you have funds in your account to channel it.

Portfolio hedge

As CFD’s is available for any asset class, you have CFD pros as an opportunity to hedge your overall portfolio.

Dividends Payouts

If you own a CFD’s, it is near similar to owning shares, and if you can hold down a CFD position during a dividend payout in the underlying stock, you will also get the dividend Payout, and I think this could be listed in the list of CFD Pros.

CFD Pros—Ability to short shares

You can profit in the falling market as well when you are trading CFD.

After hour trading

You can sometimes still purchase CFD’s from the brokers even after the market for the Asset is closed.

Choices as CFD pros

CFD also includes significant indexes, commodities, currencies, and sectors and is not limited to equity-based assets. As you have a wide array of choices for your investment portfolio and all this in one account, this speaks highly about the CFD pros and considering them as an option to make money.

CFD Cons

Leveraging through margin

As we have discussed this option as CFD Pros, let’s have a look at it as CFD cons. When you place a small deposit to fulfill your margin requirement, you get a more substantial position than without leveraging and, thus, a higher return on your investment. The point that I didn’t include in the CFD pros points is that—You can potentially lose a higher rate, if not all of your investment, and this certainly the biggest CFD Pros as well as the biggest CFD cons.

Financing charges

As while CFD trading strategies occur through trade on margin, you can essentially borrow funds from a CFD broker. If you hold the CFD position overnight, interest on the margin provided by the CFD broker has to given by your account.

This is substantially smaller in number, and first, I didn’t think to include in the CFD cons list, but I felt that I’d even explore the darkest corners of CFD trading strategies.

No voting rights is another CFD Cons.

Like I mentioned earlier, owning a CFD is similar to owning the actual shares, but you don’t own a share. As a result, you do not have the right to vote as a shareholder would.

Dividends are charged

If you are short in your company size and the time of declaring a dividend comes, your account will be charged the dividend amount.

Availability

How can this be in the list of CFD Cons? Well, if you live in the United States, then do not read this as you cannot trade CFD in the USA.

Looking for CFD Broker:

When you are choosing the best CFD broker, urge to try out their demo account to experiment with their platform, margin and overnight financing policies, minimum trade sizes, and other characteristics that are particular to those assets, you have an advantage in trading.

Here are something to clarify initially:

Regulation

You have to be sure to work with firms that are regulated under at least one primary regulatory body to find the best CFD brokers. Firms will disclose this at the bottom of their website, and/or detail it on their “About Us” section. Some public regulatory bodies are:

• The Financial Services Authority (FSA) in the United Kingdom

• The Australian Securities and Investments Commission (ASIC) in Australia

Best CFD Brokers Reputation

Check if the option you are choosing is stable and well authorized. This can quickly be done by doing a search on the internet and reading other trader accounts(reviews). Also, it is always proper to find out if the best CFD brokers provider is part of a larger financial group.

Curious Customer Support

You should call to check how fast your subjects are handled, how well trained the best CFD brokers are on the subtleties of CFD trading, how they handle fund requests, and of course, how they would manage any trade-related questions if a bad fall occurs or their software goes downhill.

Intangibles

There is plenty of competition between best CFD brokers that you can use to your advantage. Many of the best CFD brokers can provide you with internal or even third party resources that smaller, less equipped CFD brokers cannot. Some of these sources focus on daily or even live commentary for all extended markets, which can help keep you current on events.

Case of the Commissions

Most best CFD brokers charge a commission of 0.2%-0.5% of trade size each way or a minimum of $15-$35, whichever is more distinguished. Just like Margin Policies, different best CFD brokers charge various commissions on every asset class.

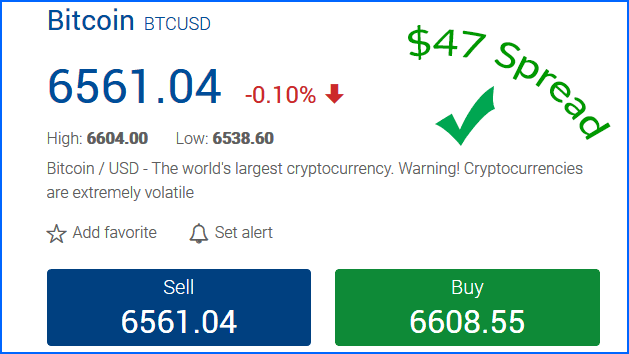

The explained—Spreads

Some best CFD brokers may offer smaller commission but provide wider spreads, whereas other providers may charge higher commissions but lower spreads. It is good to know your costs.

Some other charges

Depending on the origin of the country the CFD is being traded, where you may be charged a monthly fee to access live dynamic prices, or even get inactivity fees if you are not trading enough. Ask your best CFD brokers to list all of the fees they charge.

Margin Policies

Best CFD brokers allow at least 10:1 leverage, however, there are some best CFD brokers which may require higher margins extending from 20%-70% depending on the liquidity of that specific CFD. Also, note that best CFD brokers offer different terms even for the same asset class, so do not take for granted margin policies between the best CFD brokers.

CFD’s Availability

There is a wide range of CFDs available with the best CFD brokers. Some best CFD brokers focus on significant indices and Gold and Silver. In contrast, other best CFD brokers may offer thousands of CFD’s with all major and minor indices, thousands of singular shares, metals, interest rate vehicles, commodities, bonds.

Interest Rate

Check the base rate of the best CFD brokers— use to calculate the interest rate and what their markup is. Most best CFD brokers follow the LIBOR rate and add or subtract 4 – 5%(changes person to person) from there.

Trading Tips

There are many ways to consider as you can experiment with and decide what is best for you.

Here though are a few pointers that should work with any trading method that you can use to strengthen throughout.

Goals

Before you enter a CFD trade, you need to know what your goals are in terms of percentage targets. You necessitate to know this thoroughly and understand your thinking for doing it is on bright and well-defined conditions so you can build on it as you progress at least as a good CFD trader.

Strategy

To put the odds in your favour through simple Reward/Risk ratio’s, and using of scaling techniques to get in and out of trades or using specific indicators or chart patterns. These are of importance and can be used as a particular strategy to enter and exit a CFD trade, and in a long time, it will be useful. You must know what your plans are, and you stick to it. Also, keep it well-defined throughout the process so you can learn along understand its ups and downs—and make progress or changes accordingly.

Discipline

This is probably the hardest of all of them as it straight concerns on the sensitive side of trading. You will continuously be experimented by —desire or doubt— to change your best CFD strategy and/or your specific goals.

It is essential to know that you should not do that regularly or even before you have experimented it. However, there is always an exception to the rules, and you can alternate them in the long term.

Remember, there is always another trade, the game you are playing is never-ending, so stay disciplined and stick to it for a while, and only consider a change when you think that it has failed many times.

Notes

Many traders do not follow this, as it can be an invaluable tool in showing them an explanation of entering a trade before it takes place. But, not only this helps them explaining the logic of the trade, but also details and steps that you have to follow before entering a trade and suitable for future trades. Keeping regular notes, will give you insights into the various possibilities of CFD trading, and also alter the methods that are not profitable.

Nobody’s Perfect

Ego has no place in this game, and if only you expect to be wrong often(at least at the beginning), you will not be affected by it. Accepting the incorrect strategies in CFD trading decisions will give you mental stability and then accordingly allow you to focus on what set up will provide you with excellent results (Rewards greater to Risks), and protect your capital. Whether this is putting the parameters at risk before you trade, and changing your trading goals, it is not good to adapt to often, Instead of being patient and have understood that there are limitless possibilities. Believe in you also not—it is confusing to understand, but you see money is never understood at least not simply. Also, read WHEN NOT TO TRADE CFD’S.

I know that you want to know much, and you must know, but to understand how to trade CFD and to follow the best CFD strategies, you must do practicals rather than read the never-ending theories.

Follow us on Facebook for regular updates on our latest posts.