Forex Trading is quite a simple concept in reality and you can earn money easily with Forex which is often overlooked. The terms how to earn money from forex, how to become a successful Forex trader, What is forex trading — is known to many, yet rarely understood. In more unambiguous words, ForEx— is an abbreviation for Foreign Exchange.

Let me illustrate it in clear words about how Forex trading works, how to earn money from forex, and What is Forex trading.

(Picture credit: Business 24-7)

If you are buying one currency with another(Trade), you are making an exchange, and congratulations, you learned How Forex works. You look a bit confused, consider this— If you have taken a trip abroad; then you already participated in forex trading.

Let me narrate— YOU (expansion of highlighted terms):

You get the long-awaited permission from your office that you needed to make a trip to your childhood companion living in a different country. You both progressed in the same high school in Manchester, and he then relocated to Melbourne. You, with high enthusiasm, book a flight ticket to Melbourne, but you carried all the money (£-GBP) in cash. Your ideas were as old as you, that motivated you not to inform your friend initially and instead of overwhelming him after landing at the airport.

You boarded the flight and put your most excellent ideas into action. That is to go to an unknown city and then to call to inform him that you are in Melbourne for a little vacation.

It did initially without you knowing it, and when you told him about you in Melbourne unknown of his whereabouts, he was excited as you were (sums up that you both are indeed real friends). Still, he was about four hours distance from the airport and advised you to wait.

After the long wait of two hours, you get starving and decide to have a Ba’get. The peddler turns your order down as he was looking for $(Australian dollars), and all you have is £(GBP). Enquiring with him, you found out that there is a nearby currency exchange booth, you go there with all the heavy luggage you carried for your short trip(Man! you are smart). Moving further, as even you will not be interested in yourself, you exchanged all the 2000£. You were happy that, in return, you got 4000 Aus$ ( story-sake conversion, i.e., 1GBP=2Aus$)—You got benefit from the local economy.

By this time, your friend has come, and he buys you the Ba’get. He doesn’t let you spend even a small amount of the converted currency.

Well, the final day arrives, before leaving you to want to convert the 4000 Aus$ into £(GBP).

Table of Contents

1. How Forex Works?

Consider—The value of the GBP went up during your time in Melbourne. That is the value of Aus$ in terms of GBP has changed as the economy of the GBP got a boost during you were in Melbourne, i.e., now the conversion rates are 1GBP= 1.5Aus$

That means you got about 2500(Conversions are not even approx, well you are not the only one with smart-brains). You got a profit of 500GBP when you were dancing around with your childhood friend. You again, in the immense happiness, got struck with an idea(you get a lot of these—you may be the next smartest man on the planet). You resumed your job, and after three months, you decided to go again to Melbourne, this time with double the cash(4000GBP). Still, a good thing is that you didn’t strike with another brilliant idea of surprising your friend and told him initially about the visit.

You visited the same currency conversion shop(you got 8000 Aus$, i.e., 1GBP=2Aus$), and you were living in your little world and hoped that you’d make about 5000GBP and a vacation filled with joy. You got a joyous friend, and he didn’t let you spend any money even this time.

Little did you know, on the last day when you converted your 8000Aus$, you got only 3000GBP this time; when you confronted the shop owner, you got to know that—the value of Aus$ has gone up during your time in Melbourne. You get a decline from the local economy. This time the economy of Aus$ has got a boost, and the conversion rate is 1GBP=2.5Aus$.

I’ll not discuss your mourns and you any further, as I used you as my subject of the story, and that ends here.

Back to the topic, this is how forex trading works —you buy a specific currency with another, in the hopes that the market will move positively up so that you can profit.

(Image credit: express.co.uk)

2. How to Trade Forex

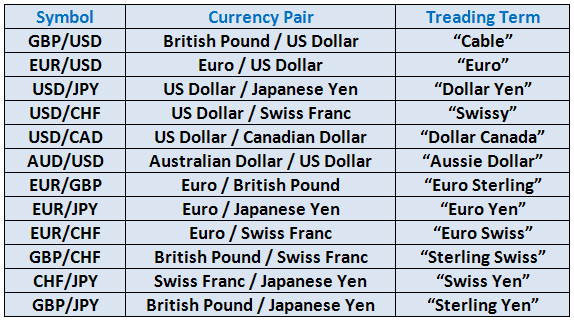

A forex pair;

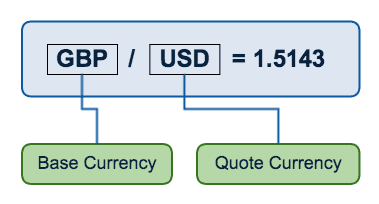

The Forex trades always happen in pairs. The pairs are like AAA/BBB. You can buy and sell the currencies only in pairs. The first currency in the pair is the base currency and the second in the pair is the quote currency. For every pair of currencies, there are two prices—the first is the Ask price: the rate at which sellers are willing to sell. The price you pay when entering a buy trade. The second is the Bid price: the rate buyers are willing to pay. The price you pay when entering a sell trade.

(Image credit: elliottwavenuggets.com)

The possible difference between the Bid and Ask price is known as the spread, which is called the cost of trading.

There are three different classes when it comes to the forex pairs that will be essential for you to become a successful Forex trader. They are Majors(more commonly traded), the Minors, and the Exotic pairs.

Note: Some individual currencies are active during their own—trading seasons.

Trading order types:

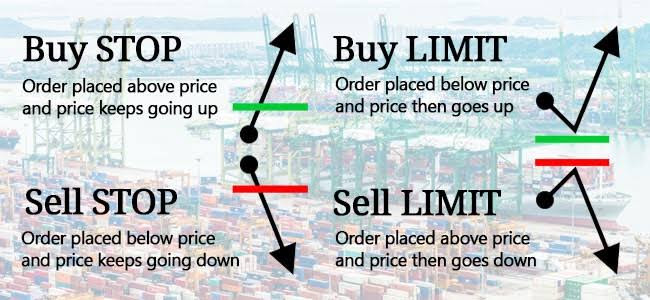

There are many trading order types, and you should know every one of them coherently to become a successful forex trader. You can answer people about how to earn money from Forex. Some of which are—

-

Market Order

This is the simplest order type in the webs of jargon on How to trade on Forex. There are market orders on Buy and market order on Sell. This gives you the prices available in the marketplace.

(Image credit: babypips.com)

-

Buy Stop Order

An order to buy that is placed above the current price. This order is generally filled at or above the stop price.

These are only two types of order types; the list is pretty big. It isn’t apparent initially, but over time you have to remember and understand every order type completely. A thing to consider is you are playing with money, and click here are critical to answer how to become successful Forex Trader.

(Image credit: medium.com)

3. Currency Value

The value of the currency is determined by the strength or weakness of the base currency. For most currencies, the base value is 1, this means when you see the EUR/USD quote as 1.4567, you buy 1.4567 of 1USD for the cost of 1EUR, and when you sell EUR/USD for 1.4557. You’d have made the profit of 10pips, and this is illustrations that show how to earn money from Forex.

(Image credit: binary tribune.com)

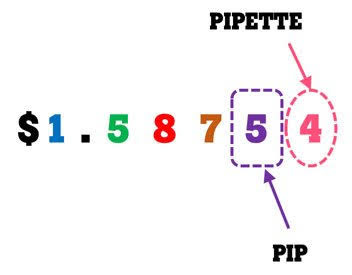

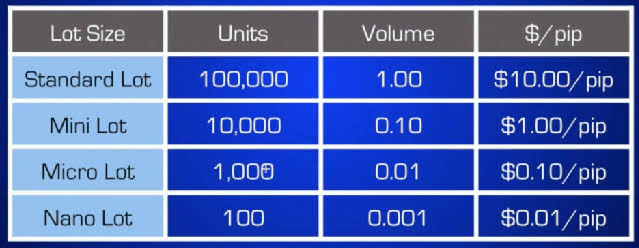

4. Price Interest Points

The underlying technicality of the PIP is— it has three different lot; the first the standard lot($100000), the other mini lot($10000), and the last the micro lot($1000). The values of PIP worth $10, $1, and $0.1, respectively.

(Image credit: fxscouts.com)

5. Risk has its own advantages

The most critical thing is that Forex trading moves with high correlation; and thus increases the chances of risk. The ratio of earning and loss in Forex trading is almost 1:1. You either make a profit, or you suffer the same amount of damage.

- Leverage:

The investment strategy in how to trade on Forex is using borrowed to increase the potential of an investment. It allows you to enter a possibility that is higher than your capital. The Leverage on how to earn money on Forex is in the ratio of 1:100, 1: 200 up to 1: 500. For example, if you take leverage of 1: 100, and you have $10,000, you can control and play with an account of $1000,000.

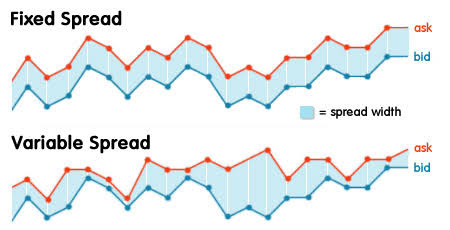

6. Spreads of Forex

This is the difference between the ask and bid. It represents brokerage service fee and replaces transaction fees. Spread is denoted as PIP’s; it is the percentage in points(fourth decimal in the currency quotation).

(Image credit: babypips.com)

There are as sizably as three spread types that you must know in knowing how to trade on forex:

- Fixed Spread: The difference is constant between the ask and bid. The market condition does not affect them.

- Above mentioned Spread(with an extension): There is defined proportion and the dealer can change some of the differences according to the market.

- Variable spread: This fluctuates according to the market.

7. The Forex Lot sizes

Lot sizes decide the PIP value. Having difficulty, let me give you an example; Take, for instance, the trade of AUD/GBP, at the price of 1.4562 and put leverage of 1:100, if you will sell this over the Lot of 0.01, and you were able to move to 1.4462; then the 98 PIP’s will generate a profit of $9.8.

- Calculating the value of PIP’s:

Take the example of AUD/GBP trade, suppose you have an account of AUD, one PIP= 0.001. You want to earn money on Forex by a trade of $10,000.

0.001*10000=10

And you were able to manage an exchange rate of 1.13876, that means

10/1.13876=8.78981

Therefore, this makes you a profit of $8.78.

(Image credit: andyWltd.com)

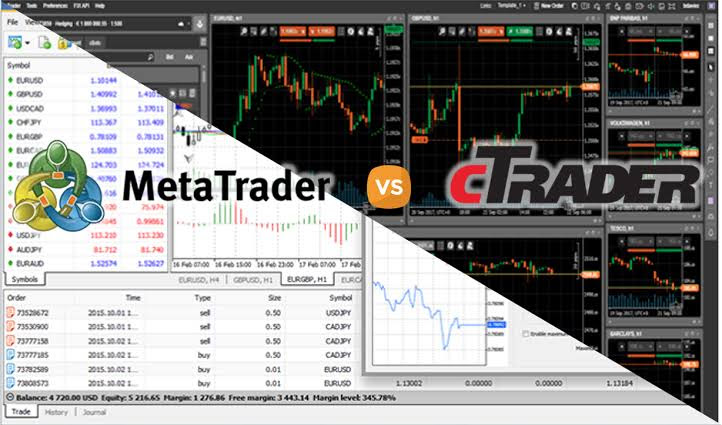

8. The platform to trade on Forex

The trading platforms have specific requirements to use them. For example, some platform requires market equity up to $25,000 in your account to opt for margin trading. There are many platforms available:

- MetaTrader4.

- Interactive Brokers.

- Trade Station.

- TDA meritrade.

(Image credit: matchtradetech.com)

9. How to become a successful Forex trader?

- Will, the above mentioned will make me a successful Forex Trader?

- Will I be rich trading on Forex?

- How soon will I be making money on Forex?

The best time to Trade Forex:

Yes, everything is the key when the risk is real Money. Even the dates and time matter a lot, so adjust your schedule if you are going to play as a real trader.

With thorough research, many magazines and big retail traders believe that—the most significant movements of the four currency pairs —the USD/EUR, the GBP/USD, the USD/JPY and the USD/CHF are observed and happen on Tuesdays and Wednesdays.

As these days show the most significant movement in currencies as most of the data of economy releases on these two days of the week.

Fridays are the busiest too but only till Noon. And the other of the Fridays and other days of the weeks are unpredictable.

When Not To Trade Forex:

- Bank Holidays

- Fridays Afternoons and weekends

- Release of News Events

- Asian Sessions

- Market Closing Time

- End of December- Saint Nicholas is tight a guy

- Overnight

- And the most important one—when you are frustrated and angry.

What Moves Forex Markets:

A tickle about retail traders is that they don’t have all the time of the day to stare at the charts, because they are most considering this Forex option—to earn some upper chunks besides what you are already getting. And you have other things to do.

Do not worry, though, and as I mentioned clearly that Understanding the charts are the keys for how to trade on Forex. You can know when the Forex Charts hits hard by only viewing News and Economic Calendar daily. In other Fundamental Forex Words—by performing fundamental analysis. In clear words, these essentials are indicators of where investors intend to invest their money and which pairs will give the most influential results.

Politics:

- Public Statement.

- When official get Switched or removed.

- Question of Stability of the Government.

Natural Disaster:

- Hurricanes

- Earthquakes

- Floods

Central Banks:

- Interest Rates alterations.

- Finance Circulations.

- Mandatory reserved funds get in play.

Economics:

- GDP, debt, and Inflation of the countries.

- Sales amounts.

- Interest from Investors.

(image Credit: Quora.com)

The above image demonstrates the impact on Pound due to the events of BREXIT.

10. Some Forex Strategies.

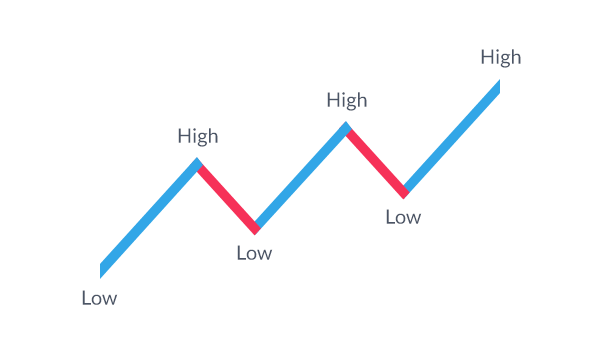

Support and Resistance:

Ever heard of “Buy Low and Sell High” this is the same business model which follows the principle of the mentioned. You can quantify the levels of how low is price’s low and how high it’s high by analysing areas where prices have stopped and Change the lines of the charts.

(Image Credit: Steemit.com)

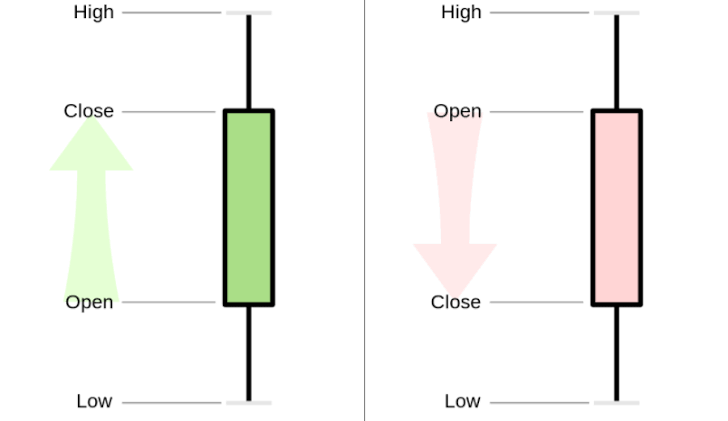

Pinocchio strategy:

Do you remember the Pinocchio Nose grew long when he was lying? The same happens with this when following this Strategy, when the wick is longer than the body, it means that the market is not conforming to your prompt and you better trade the opposite way.

The Candlestick Bar in the Forex charts is nicknamed as Pinocchio Bar—a petite body and a very wick.

(Image Credit: Alpari.com)

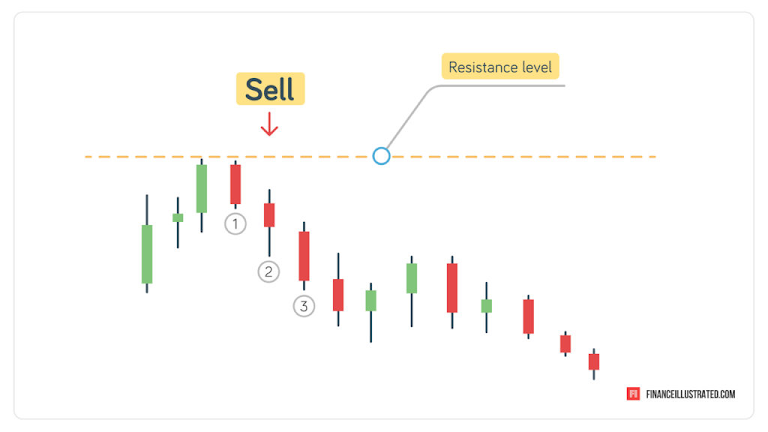

The Double Red Strategy:

This strategy is based on the short time-reversal system about price action and resistance.

This trade is followed accordingly with 5-minutes charts and signalled when two Pinnochio bars form following a test of resistance.

How to Profit From the Double Red strategy:

Choose a pair and watch the market until you see the first red bar. And be patient about the second one to appear.

If the second one closes lower than the first one, then congratulations you have hit the jackpot.

Image Credit: financeillustrated.com

With all the points mentioned above, still, this may be hard at the start. The critical thing to remember in how to trade on Forex is that it requires patience and much learning. Money is never straightforward and cannot be played with around.